Earning Opportunity for all existing agents with Getmore Loan Partner Program

The Indian loan industry has a vast potential for growth that is already visible due to increased customer satisfaction and the network’s expanding reach into unserved markets. Direct selling agents(DSA) lead this transformation, linking financial institutions and individuals. Whether you’re seeking a Home Loan, Business Loan, Loan Against Property, Car Loan, Education Loan, Credit Card, Insurance Products, Mutual Funds, Auto Loan, or Gold Loan, a DSA proves to be beneficial and creates confidence in the company’s brand image. This approach will be exciting because it fosters the required development of small businesses and industry giants using offered loans.

A direct selling agent (DSA) is an efficient link that channels communication between financial institutions like banks and non-banking financial corporations (NBFCs). DSAs are assigned primary duties that are associated with them, and they include:

DSAs provide an extensive range of financial products, such as personal loans, home loans, business loans, loans against property, car loans, education loans, credit cards, auto loans, gold loans, and many more under one roof. They earn payouts based on loan disbursements they facilitate.

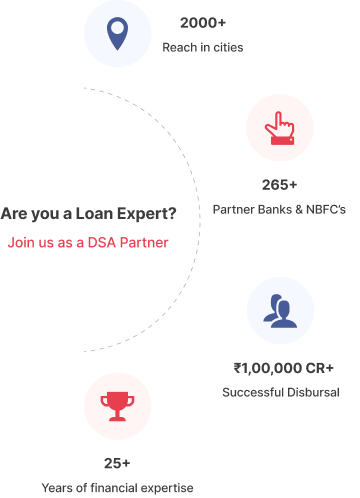

Registering to partner with Getmoreloan makes for a good start to a successful DSA career. This guide will walk you through each Online Loan DSA Registration step as you begin and grow your business.

Once you’re comfortable with the processes and procedures, an agreement will be inked between you and Ruloans. Once signed and stamped, you will be an official Getmoreloan Loan DSA Partner running a Loan DSA Franchise.

We are a home loan company that provides home loan facilities to builders and their customers.

Copyrights Under @Meramarket.